Lifetime allowance

Under previous plans the. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here.

Lifetime Allowance Explained How To Avoid Tax Bills On Pension

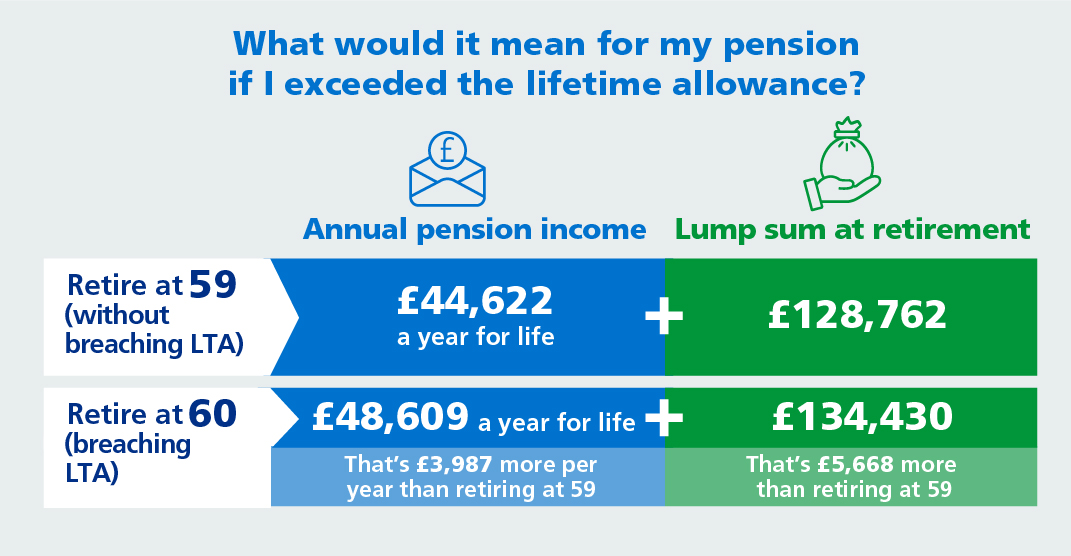

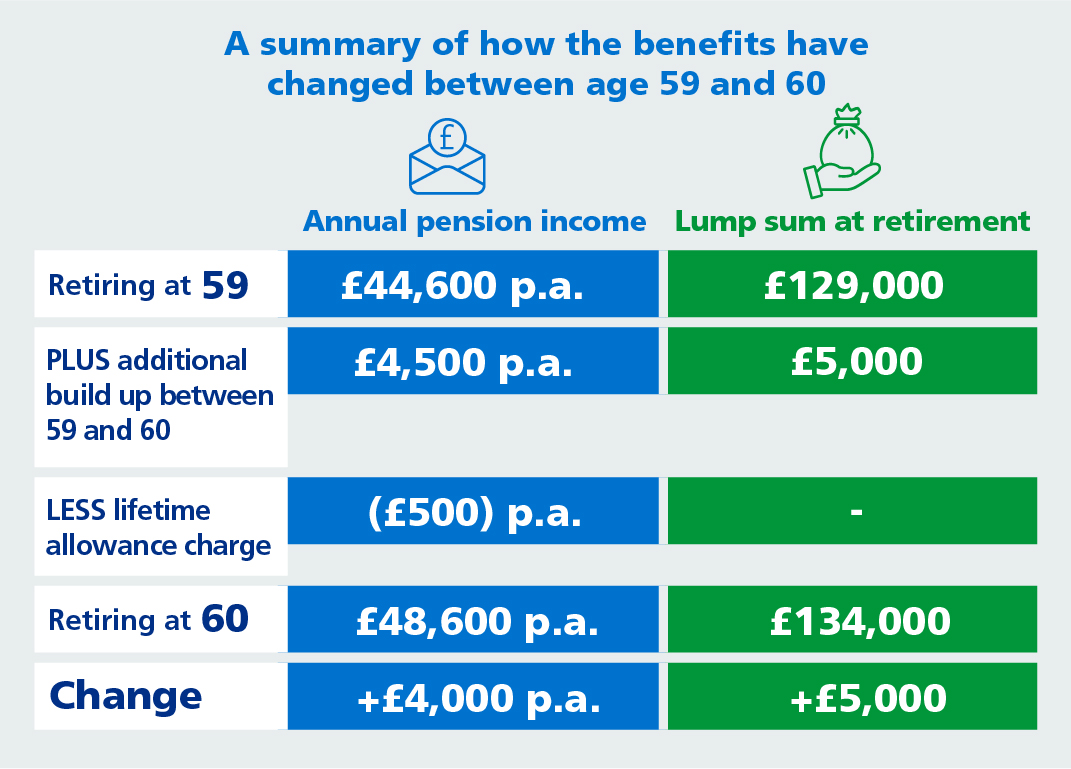

It can be paid as a lump sum or taken as a pension in the future.

. Web The rate depends on how this excess is paid to the member of the pension scheme. Web For pensions the Lifetime Allowance LTA is the overall limit of tax privileged pension funds a member can accrue during their lifetime before a Lifetime Allowance tax. Web 1 day agoCurrently the lifetime allowance caps the total amount a person can save in a pension without having to pay an additional tax charge.

Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. The lifetime allowance limit 202223 The 1073100 figure is set by. Web The lifetime allowance for most people is 1073100 in the tax year 202223 and has been frozen at this level until the 202526 tax year.

The lifetime allowance is the maximum amount of pension scheme funds that can be or deemed to be crystallised usually to. Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax. Web 2 days agoThe lifetime allowance is the amount that someone can save in total for their private pension without incurring a tax charge.

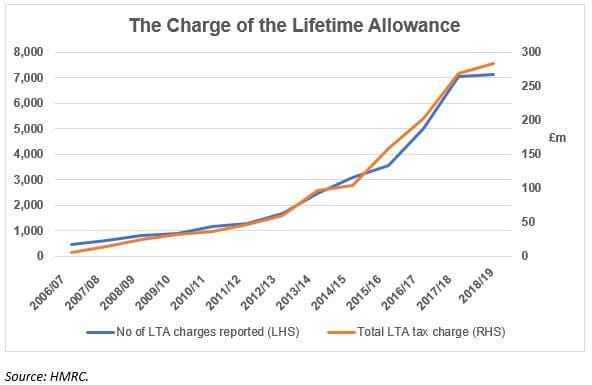

Web The lifetime allowance charge applies to individuals who have benefits in excess of the lifetime allowance when benefits are taken. Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year. The other is the annual allowance and.

Tax relief on any pension benefits taken over this amount is recovered by the application of the lifetime allowance. The allowance applies to the total of all the. The lifetime allowance charge.

Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge. Web The Lifetime Allowance LTA is the overall amount of pension savings that you can have at retirement without incurring a tax charge.

Web The standard lifetime allowance is 1073100. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply. It means people will be allowed to put.

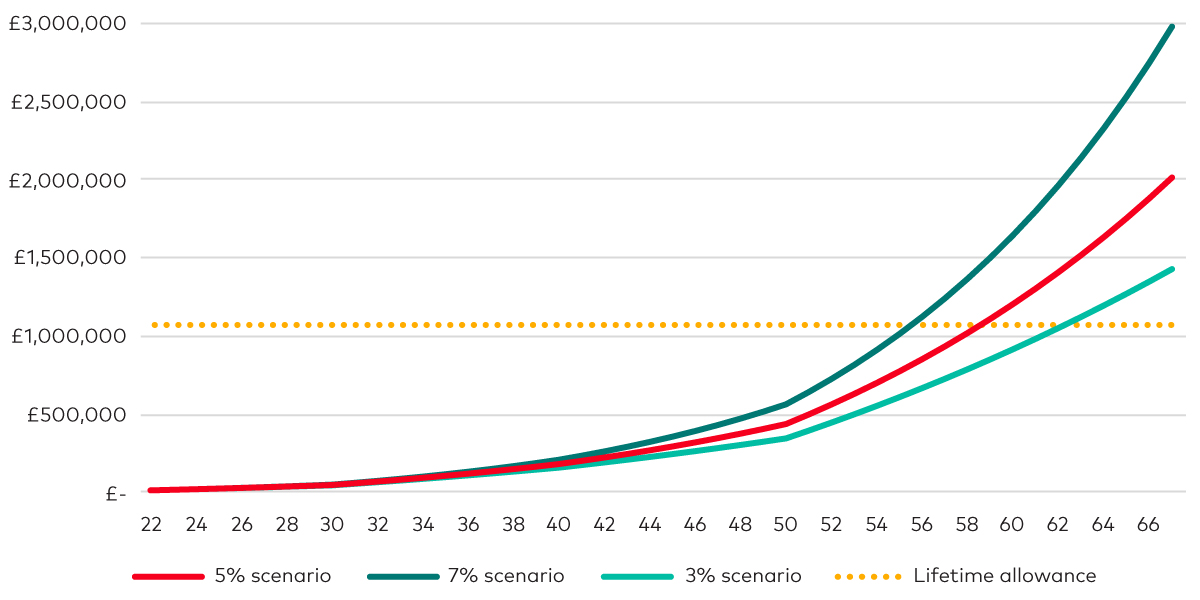

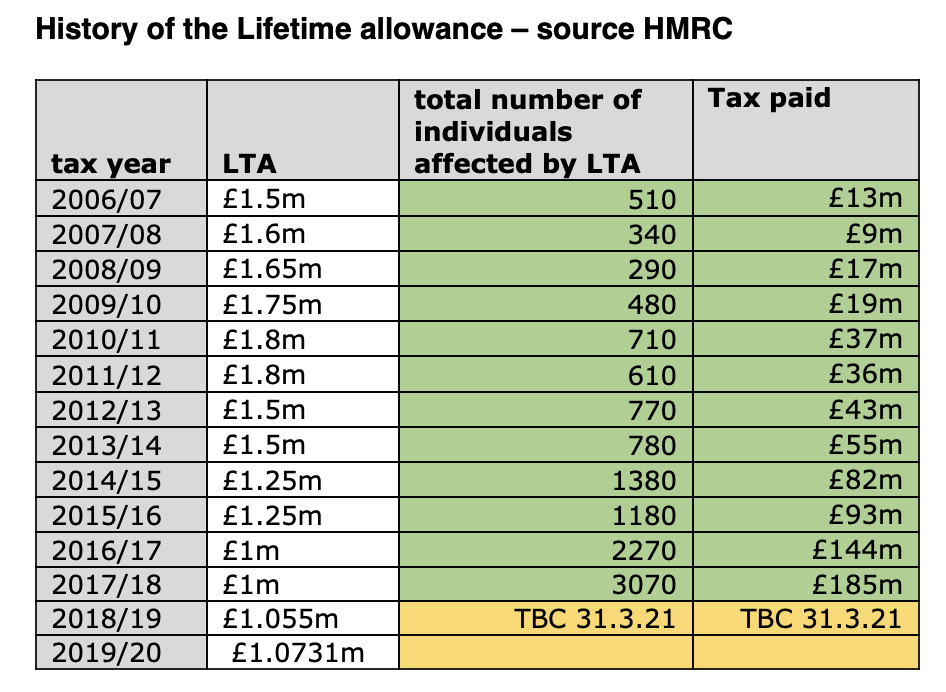

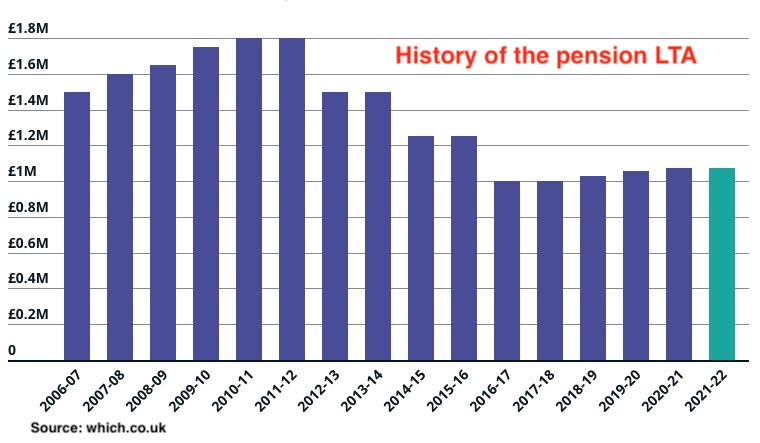

This is currently 1073100. The chart below shows the history of the lifetime allowances. The current standard LTA is 1073100.

Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026. Web A lifetime allowance charge can only apply when the value of an individuals pension savings at a benefit crystallisation event is over the lifetime allowance. Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax.

Mr Hunt will outline his Spring. You might be able to protect your pension pot from. Lump sum rate 55.

Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. Web The current lifetime pension allowance LTA currently stands at 107m meaning those with money in their pension pot incur tax only after that threshold has. Each time you take payment of a pension you use up a percentage of.

It has been frozen at 1073m since the. Web What is the lifetime allowance. Web 2 days agoCurrently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m.

Web 17 hours agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. Web Lifetime allowance You usually pay tax if your pension pots are worth more than the lifetime allowance.

Cefqvtv5jxgrmm

What The Lifetime Pension Allowance Is And What It Might Mean For You Vanguard Uk Investor

1uuqbdv2buutum

Will The Pension Lifetime Allowance Increase In The Uk What To Expect Bm

Navigating The Lifetime Allowance Charge Under 75 Nucleusfinancial Com

Nhs England Understanding The Lifetime Allowance

How Quickly A Pension Pot Could Breach The Lta Professional Paraplanner

Pension Lifetime Allowance Explained St James S Place

Ruaz0igmqqkdom

Thousands Lose Lifetime Allowance Protection Since A Day Money Marketing

Pension Lifetime Allowance Explained Nerdwallet Uk

Pension Lifetime Allowance Explained Get Lifetime Allowance Strategies

What Is Pension Lifetime Allowance Lta And What Happens If You Exceed Your Allowance

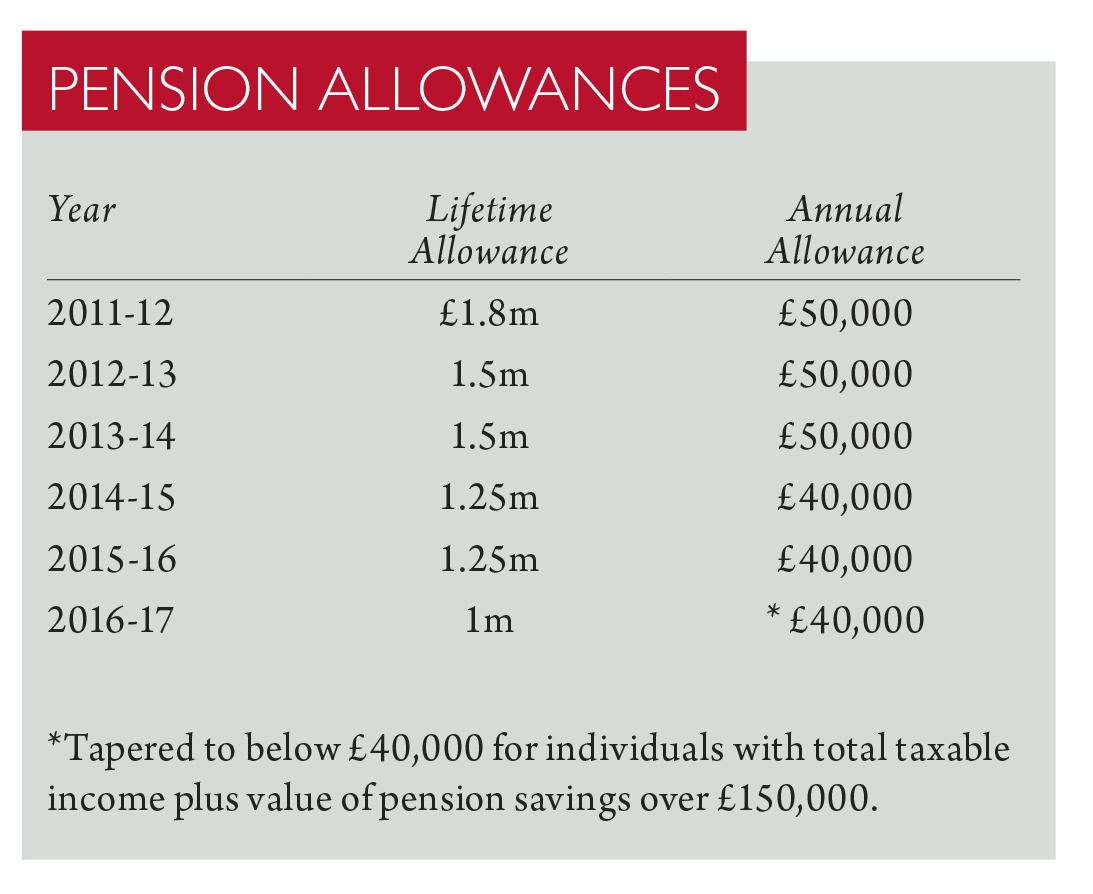

Annual And Lifetime Pension Allowances Taxation

Pension Lifetime Allowance Cuts On The Horizon Chase De Vere

Nhs England Understanding The Lifetime Allowance

Is A Further Reduction In The Lifetime Allowance On The Cards Melbourne Capital Group Insights